Welcome To Adrian Edge Ventures

A Global Investment Firm dedicated to funding and mentoring high-potential startups across diverse industries. With a proven track record in private equity and venture investments, we provide not just capital, but strategic guidance, industry connections, and a value-driven approach to accelerate business growth.

500+ Clients

Trusted By

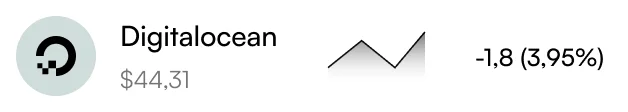

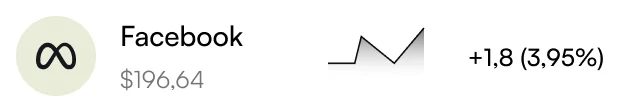

Investment Portfolio

At Adrian Edge Ventures, we take a strategic and disciplined approach to investing in high-potential startups and growth-stage companies. Below is an overview of our investment fund, including our focus, philosophy, and key investment strategies.

About Our Investment Funds

Fund Size & Focus

Our investment fund is dedicated to supporting innovative and high-growth startups. Investment sizes typically range from $100,000 to $2 million, depending on the specific needs, objectives, and potential of each company.

Geographical Focus

Over the past two years, we have successfully invested in more than 15 startups across the United States and Europe. Leveraging deep expertise in these markets, we are now expanding our investment reach to high-potential startups in Asia and South America, reinforcing our commitment to identifying and backing transformative businesses on a global scale.

Investment Philosophy

Rigorous Evaluation Process

Each potential investment undergoes a thorough assessment, including a comprehensive review of its business model, financial stability, market potential, and leadership team. This meticulous approach ensures that every investment is built on a strong foundation for long-term success.

Sector-Agnostic Approach with a Focus on High-Growth Industries

While we remain open to opportunities across various industries, we prioritize investments in high-growth and disruptive sectors. Our focus includes:

- Agriculture

- Technology

- Fintech

- Biotechnology

- Healthcare

- Artificial Intelligence (AI)

- Renewable Energy

Our Goal

Our goal is to identify businesses with the potential to become market leaders while delivering substantial returns and industry innovation.

Why Partnering with Us is the Right Choice

At Adrian Edge Ventures, we don’t just invest in companies—we partner with founders to drive meaningful growth and long-term success. Here’s why being part of our portfolio is a game-changer

-

Proven track record of successful investments

-

Strategic guidance beyond capital funding

-

Flexible and founder-friendly investment structures

-

Strong commitment to transparency and accountability

-

Tailored investment strategies for sustainable growth.

Investment Strategy & Approach

Investment Stage Focus

At Adrian Edge Ventures, we primarily invest in early to growth-stage companies, where the potential for significant returns is highest. By supporting businesses that have successfully established proof of concept but require capital to scale, we help them accelerate growth while mitigating the risks associated with pre-revenue startups. However, we remain open to opportunities across all stages, including seed funding and late-stage growth, particularly when a strong exit strategy is evident.

Risk Management Strategy

Value-Added Approach

Exit Strategy

Our exit strategy is primarily driven by strategic partnerships, mergers, and acquisitions (M&A). We seek exits once a company has demonstrated sustainable growth and profitability. In select cases, particularly in high-growth sectors such as biotechnology and fintech, an initial public offering (IPO) may be pursued to maximize returns.

Deal Structures

For international investments, especially in Asia and South America, we commonly utilize SAFE (Simple Agreement for Future Equity) notes or convertible notes, allowing for greater flexibility in valuation discussions and risk management.

Investor Expectations

Empowering Startups with Strategic Capital & Expert Guidance

What Our Partners Say

Hear from founders and executives who have experienced the impact of our strategic investments, mentorship, and industry expertise.

Questions?

Get answers to common questions about our services.

Need more information?

If you have more inquiries, we’re here to help. Check the FAQs below or reach out directly for assistance. We’re committed to making your experience seamless.

Our primary focus is on innovative companies that are shaping the future. We look for unique business models and strong leadership. This drives our investment choices.

We generally invest between $100,000 and $500,000, depending on the opportunities available. Our goal is to support projects that align with our vision and values.

We are flexible with deal structures, often working with equity or convertible notes. The approach we take is tailored to the needs of the business we’re supporting.

After investing, we stay actively involved. We provide support and guidance to ensure growth, while respecting the management team’s space to lead their business.

Absolutely! We encourage inquiries. Please don’t hesitate to reach out directly. Your questions are important, and we’re here to assist you.